IFRS18 Playbook for Oracle EPM (Part 1)

- Dipen Shah

Purpose

Oracle EPM delivers the scalability and agility necessary to address growing reporting demands. Its flexible architecture lets you swiftly adapt to new reporting and disclosure standards. This document outlines the technical approach for deploying IFRS 18 reporting within Oracle EPM.

Introduction

The International Accounting Standards Board (IASB) has introduced one of the most significant changes to financial reporting over two decades with the publication of IFRS 18 Presentation and Disclosure in Financial Statements in April 2024. This groundbreaking standard will fundamentally reshape how companies present their financial performance, introducing structured income statement categories, mandatory subtotals, and enhanced disclosure requirements for management-defined performance measures. As organizations prepare for the mandatory effective date of January 1, 2027, understanding the technical complexities, implementation challenges, and compliance implications of IFRS 18 becomes crucial for finance professionals, auditors, and business leaders navigating the evolving landscape of international financial reporting standards.

Requirements

IFRS 18 introduces three fundamental sets of requirements:

- Classification of income and expenses into five major categories:

- Operating

- Investing

- Financing

- Income Taxes

- Discontinued Operations

- Two new mandatory subtotals:

- Operating Profit or Loss

- Profit or Loss before Financing and Income Taxes

- Disclosure for the Management-Defined Performance Measures (MPMs)

IFRS 18 Playbook for Oracle EPM

If you are already using Oracle EPM platform for statutory and regulatory financial reporting, you can be an early adapter of IFRS 18 reporting. Early planning allows organisations to identify and address implementation challenges before they become critical issues.

The IFRS 18 implementation process requires careful project management, with clear timelines, resource allocation, and stakeholder engagement strategies. The planning process should include comprehensive gap analysis comparing current processes, reporting and disclosures with IFRS 18 requirements. This analysis should assess impacts on financial statement presentation, disclosure, system capabilities, and processes. The gap analysis provides the foundation for developing detailed implementation roadmap and resource requirements.

Technical Details

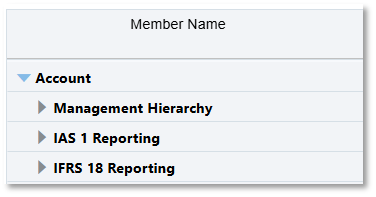

Redesigning your chart of accounts is the cornerstone of any IFRS 18 rollout. Start by reviewing both your Oracle EPM COA and, if different, your ERP COA and run a fit-gap analysis to confirm that each source system captures all data and granularity required for IFRS 18. Then leverage Oracle EPM’s alternate hierarchies: add an IFRS 18-specific view to your Account dimension while retaining your existing statutory structure. This dual-hierarchy model lets you produce IFRS 18 statements and reconcile them seamlessly against your IAS 1 reports and enables like-for-like (L-F-L) reporting.

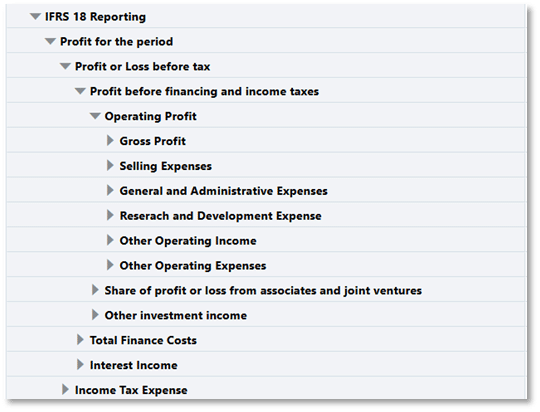

IFRS 18 alternate structure needs to be created with the mandatory subtotals:

Implementing an alternate account hierarchy alone may not address every reporting scenario. In some cases, activities classified as financing at the subsidiary level must be reported as operating at the group level. This isn’t unique to IFRS 18, it’s a longstanding challenge that Oracle EPM can handle in several ways:

- Post a topside adjustment directly within the EPM application

- Use the out of the box functionality for automatic reclassification

- Develop a custom script for reclassification

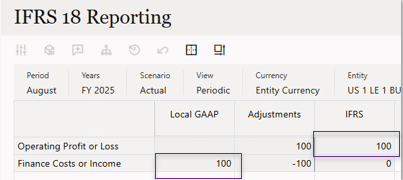

All these approaches rely on having a Multi-GAAP or Audit Adjustments dimension in your EPM model. In one of the examples below, we used the FCC application, but if you’re working in Planning or FreeForm, you can create a similar custom dimension to meet the same requirement.

The view below demonstrates that an item is reported as the financing activity, but for the group, the same item is reported as the operating activity automatically:

The out of the box functionality within Oracle EPM passes the reclass entries between the financing activity and operating activity automatically. The subsidiary company’s reports are generated using Local GAAP, where the element is reported as the financial activity while the group reports are generated using IFRS, where the same element is reported as the operating item.

Oracle EPM FCC offers multiple routes to IFRS 18 reporting – stay tuned for Part 2

Conclusion

IFRS 18 is set to redefine financial reporting by overhauling how companies present and disclose performance. Its detailed mandates on income statement layouts, required subtotals, and management-defined performance metrics will drive greater transparency, comparability, and decision-usefulness. By leveraging Oracle EPM, organisations can jump-start their IFRS 18 readiness and stay ahead of the compliance curve.

Request for

services

Find out more about how we can help your organisation navigate its next. Let us know your areas of interest so that we can serve you better.